One Constellation

Businesses and financial institutions can securely streamline their onboarding process with One Constellation's premium E-KYC solutions, which include Know Your Customer (KYC), Know-Your-Business (KYB), and Know Your Wallet (KYW) services.

Who We Are?

Our platform specializes in digitalizing and automating compliance regulations without compromising customer privacy.

With us, you can relax and be assured that your KYC requirements will be met quickly and efficiently to reduce complex workflows while still adhering to industry standards.

As a global organization, our reach stretches far and wide, with offices across Asia Pacific, India, Africa, the Middle East, United Kingdom & United States of America.

What is One Constellation?

Imagine a world where compliance is effortless, and customer onboarding is seamless.

There is always a need for a trailblazing platform in regulatory E-KYC compliance, a ground-breaking software that revolutionizes the way businesses approach due diligence. A platform that ensures streamlined onboarding, simplifies compliance processes, and empowers organizations to navigate the evolving regulatory landscape with ease.

We are helping businesses streamline processes and guaranteeing that compliance regulations remain intact.

Why Choose Us

FinTech Certification

One Constellation Achieves SFA FinTech Certification,

Receiving the Fintech Certification from the SFA reaffirms our dedication to maintaining utmost levels of security, compliance, and technological excellence. It reflects our unwavering commitment to protecting sensitive data and fostering unwavering trust among our valued clients.

A Commitment to Excellence

Receiving the Fintech Certification from the SFA is a testament to the relentless efforts of our exceptional team. Their expertise and dedication have played a pivotal role in attaining this remarkable achievement. We owe our success to their commitment to pushing boundaries and delivering exceptional solutions that set us apart in the fintech industry.

As we celebrate this milestone, we remain steadfast in our mission to drive innovation, enhance customer onboarding experiences, and set new benchmarks in compliance and transaction monitoring. The Fintech Certification from the SFA strengthens our promise to empower businesses with secure, efficient, and industry-leading e-KYC solutions.

Key facts from a report by McKinsey

- Customers expect B2C-like experiences: Banks with top customer experience scores see 3% growth, 15% revenue increase, and -4% efficiency ratio advantage.

- Poor data quality drives costs: Data-quality problems contribute up to 26% of operational costs due to non-standardized formats and incomplete data.

- Increasing costs, decreasing budgets: US financial-crime compliance costs have risen by around 43%, while KYC-program budgets are projected to decrease by up to 25%.

Efficiency improvements in banks lead to significant benefits in risk effectiveness, customer experience, and productivity. A 20% increase in KYC-process automation results in improved quality-assurance scores, reduced customer outreaches, and increased case processing efficiency. Today, customers demand ease and efficiency. And we recognize this challenge and provide a simple solution through our platform. At One Constellation , we make this vision a reality

Standout Features

Cutting-edge AI Technology:

- Accurate and reliable customer identification.

- Enhanced security measures and reduced fraud risks.

- Improved efficiency in document verification and facial recognition

Seamless Integration with Third-Party Data Sources:

- Access real-time data from trusted external sources.

- Conduct comprehensive due diligence for informed decision-making.

- Save time and effort through automated data retrieval.

Scalable and Adaptable Compliance Solution:

- Easily adapt to changing regulatory requirements.

- Ensure compliance while scaling your organization.

- Maintain a competitive edge in the compliance landscape.

Key Features

Effortless Client Onboarding with Digital KYC:

- Accelerate and streamline the onboarding process for your clients.

- Enhance compliance by integrating AML regulations

- Improve customer experience and satisfaction.

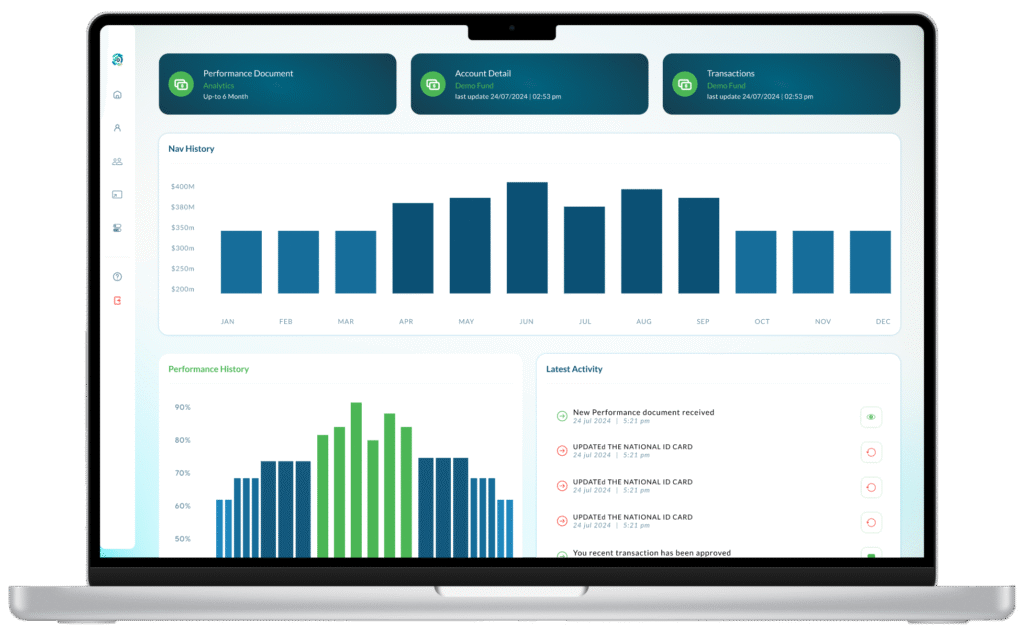

Comprehensive E-KYC Compliance Portal:

- Centralize compliance management for easier oversight and control.

- Stay up-to-date with evolving regulatory requirements

- Reduce compliance risks and potential penalties.

Dynamic Transaction Monitoring:

- Detect suspicious transactions in real-time for enhanced security

- Proactively mitigate risks associated with financial fraud.

- Ensure compliance with anti-money laundering (AML) regulations.

Want to find out more?

Book your Demo now.

Frequently Asked Questions

One Constellation is a Software as a Service (SaaS) solution hosted on Google Cloud Services in Singapore. It provides a comprehensive EKYC and AML/CFT Compliance Portal, facilitating digital identity verification, document submission, and compliance management for efficient customer onboarding.

One Constellation, hosted on Google Cloud Services in Singapore, employs encryption protocols, secure data storage, and compliance with data protection regulations to safeguard customer information. Regular security audits and updates are conducted to maintain the highest standards of data security.

Yes, we do. You may reach out to us at sales@one-constellation.com to discuss in detail.

Yes, One Constellation, as a SaaS solution, can be customized to align with the specific requirements of different industries and regulatory environments. The portal’s flexibility allows businesses to adapt to evolving compliance standards.

Yes, One Constellation includes features for ongoing monitoring of customer transactions and behavior to identify and report any suspicious activities. This proactive approach helps businesses using the portal to comply with AML/CFT regulations.

One Constellation generates comprehensive reports on customer onboarding, identity verification, and AML/CFT compliance measures. These reports can be used during audits and regulatory inspections, providing businesses with a clear demonstration of compliance with industry standards.

Absolutely. With certifications from the Singapore FinTech Association, ISO 27001, and SOC Type 1 and Type 2, One Constellation ensures a secure and compliant environment for customer onboarding. Our commitment to these standards underscores our dedication to providing a trustworthy EKYC and AML/CFT compliance solution.

Yes, comprehensive training and support are provided to users for effective utilization of One Constellation. This includes user guides, tutorials, and customer support to ensure a smooth onboarding experience.